- Features

- Payment Methods & Custom Taxation

Payment Methods & Custom Taxation

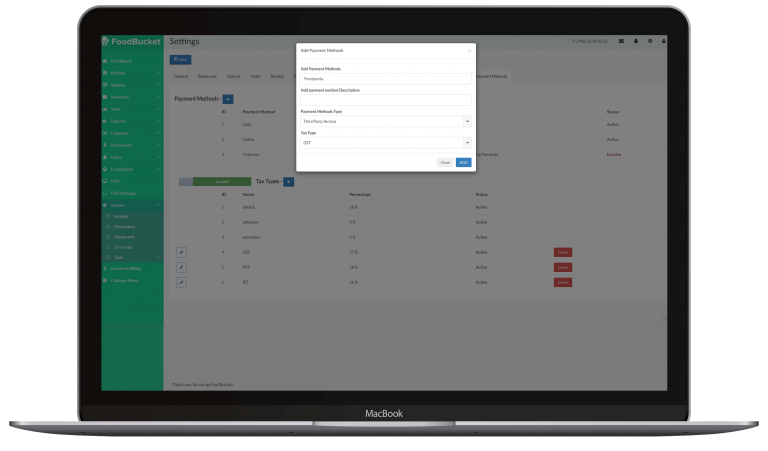

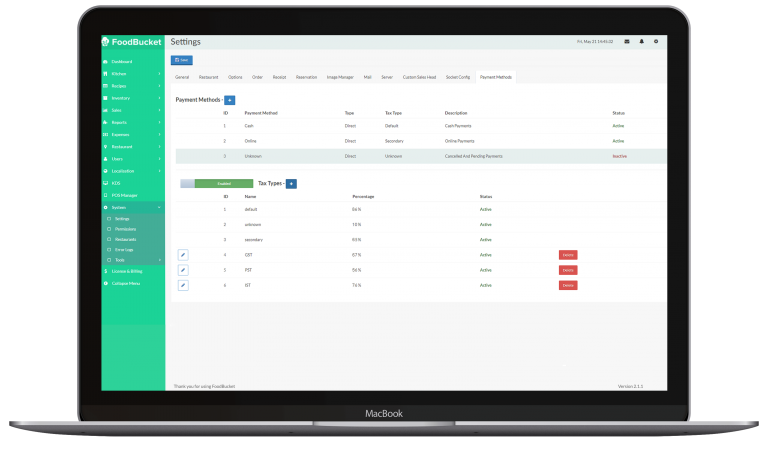

FoodBucket allows you to add all the payment methods and the taxation system that will streamline your cashflow's.

The payment Methods & Custom Taxation feature offers a range of payment options and customizable tax rates, making transactions seamless for both businesses and customers. It allows businesses to manage taxes more efficiently and ensures that customers have a convenient and secure payment experience.

Add as many Payment Methods as you like

Link Taxes with Payment Methods

You might need to charge taxes on your sales, and then report and remit those taxes to your government. FoodBucket allows you to link taxes to your payment method.

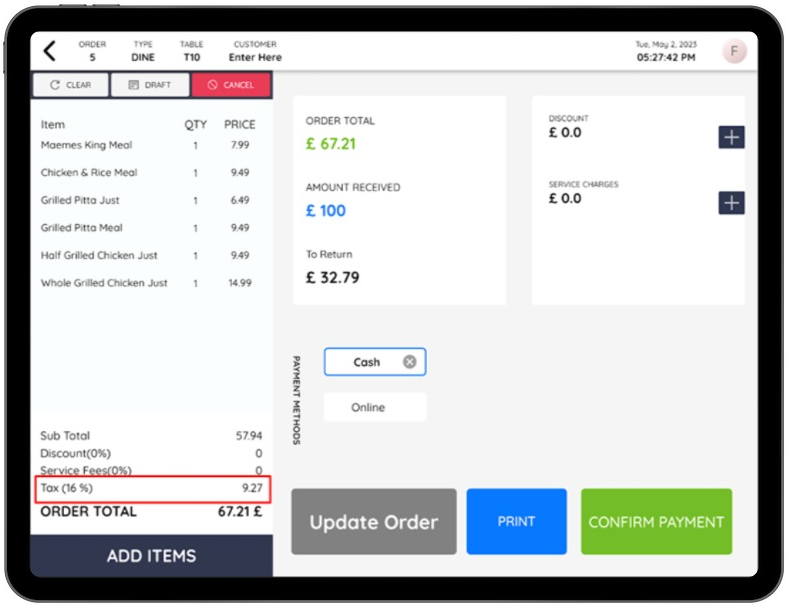

Auto Tax adjustment with Payment selection

FoodBucket allows restaurant owners easy tax adjustments.

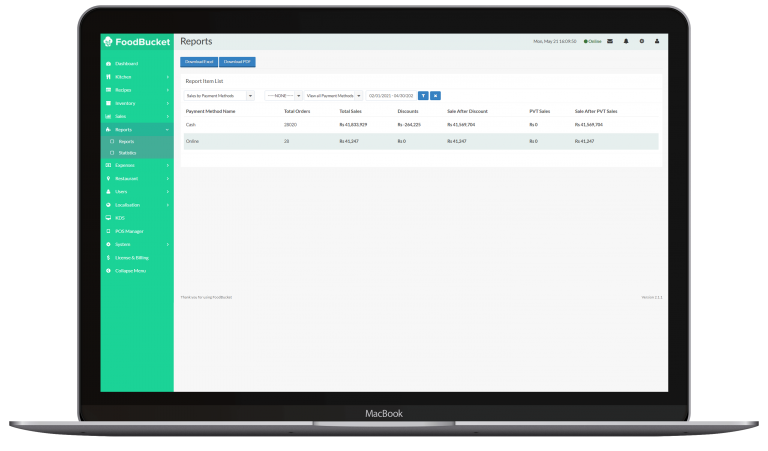

Get Payment method based Reportings

Create the right discounts for the right customers and the right times

Apply Discounts directly from the POS

Increase sales, retain old customers and earn new ones by offering gift cards

Engage your customers and streamline checkouts with a Customer Display System

Build a community of repeat customers

Display dynamic and custom imagery on your Customer Display System

FoodBucket's restaurant management system provides easy payment methods and custom taxation for a seamless dining experience.